How to Check a VAT ID

Christian Barra

Checking VAT IDs is a crucial step of tax compliance when selling B2B.

B2B customers can provide false VAT IDs so they can avoid paying consumption tax on their purchases. In EU, it’s your responsibility to verify that these business VAT IDs are valid.

If you don’t check the validity of customers’ VAT IDs, and if you apply the reverse-charge mechanism to a sale where the buyer has a fake VAT ID, then you'll be liable to pay the VAT tax directly.

How do I check an EU VAT number?

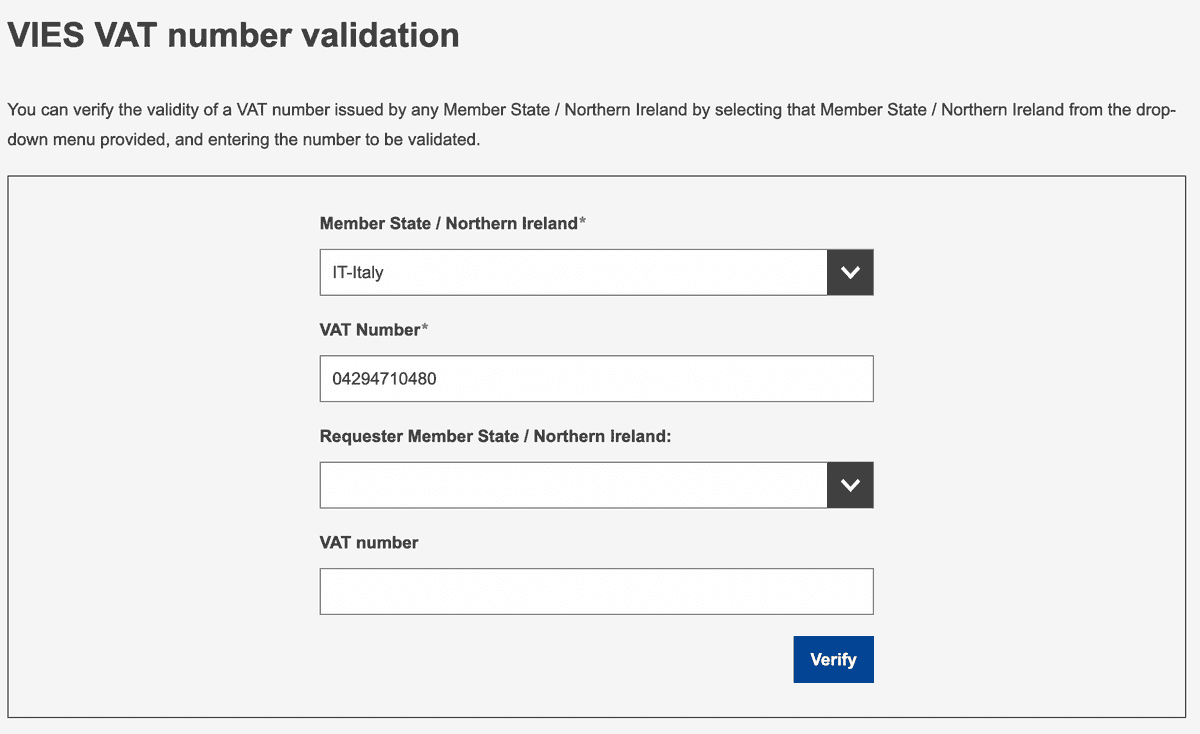

VIES

If you’re selling in the EU, the VAT number lookup is provided through the VIES. The data is retrieved from national VAT databases.

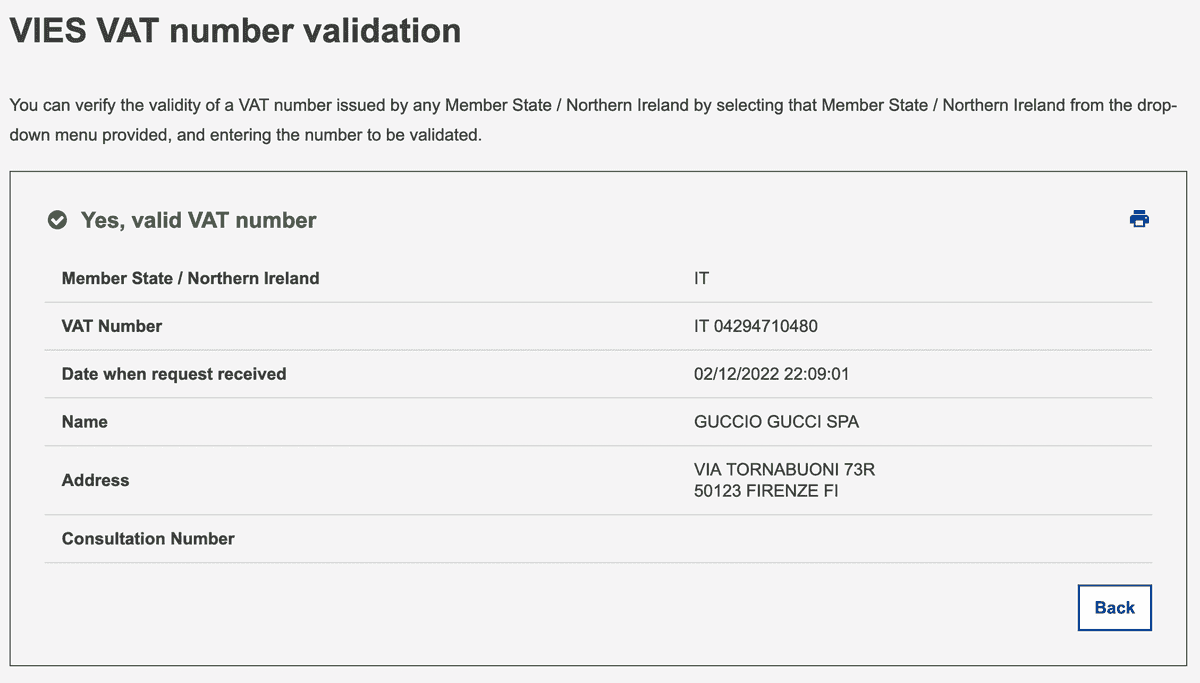

And after you click verify

If the system returns an invalid status it means that the VAT number you are trying to validate is not registered in the relevant national database.

Check with your customers if the VAT ID is correct and whether they have been activated for intra-EU transactions.

API

The EU offers VAT IDs verifications through the VIES portal, but the process is fully manual and has to be done for each VAT ID that you want to verify.

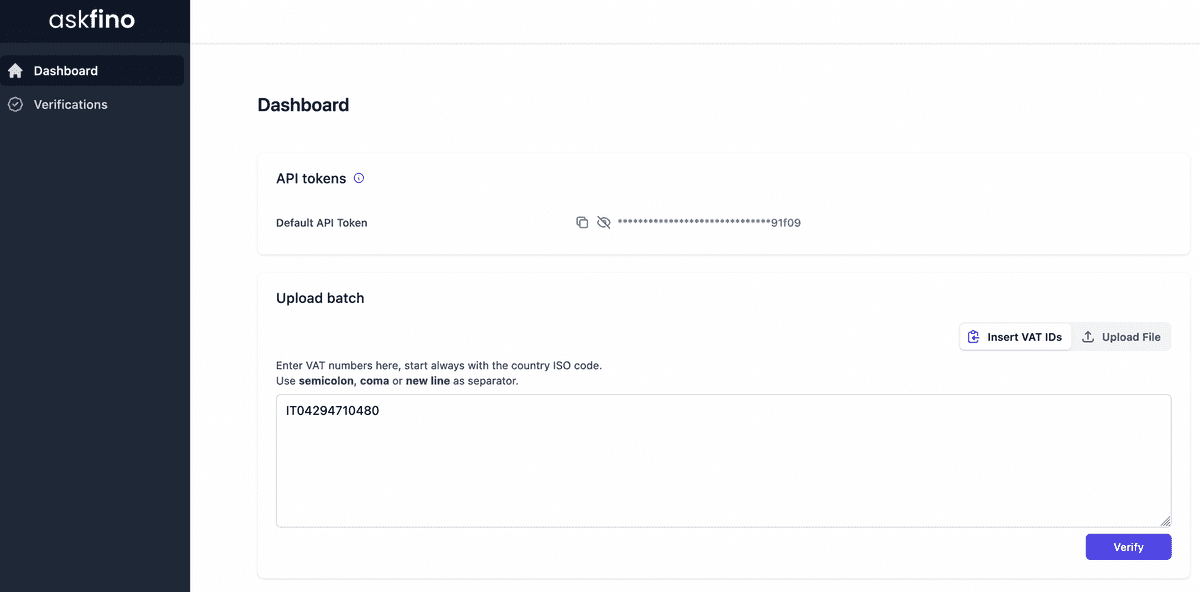

Another way to check VAT IDs is by using Askfino API.

A response for VAT ID GB333289454 would look like this:

{

"id": "0184d2f81d96eb4c7583d6bc650e972c",

"vat_id": "GB333289454",

"external_id": "",

"country": "GB",

"status": "VERIFIED",

"company_address": "BROADCASTING HOUSE, FLOOR 6 (ZONE B/C), PORTLAND PLACE, W1A 1AA",

"company_name": "BRITISH BROADCASTING CORPORATION",

"verification_number": "pIG-hTQ-WuS",

"verified": true,

"valid_format": true,

"verified_at": "2022-12-02T13:13:06.961917Z",

"created_at": "2022-12-02T13:13:06.710927Z"

}

You can see that we provide both valid_format (the VAT ID is formally correct) and verified using the national databases.

By using our API you can integrate with your ERP workflows or checkout process, fully automating VAT ID checks.

Bulk verification

Checking VAT IDs can be time consuming, especially if it's done one by one.

While this is not possible directly with VIES you can leverage Askfino API bulk verifications to verify hundreds of VAT IDs at once.

If you have a list of VAT IDs or a spreadsheet upload a CSV file and start the validation process.

Once finished, you’ll be notified via email with a report containing the result of the VAT ID checks.

If you have to check a large number of VAT IDs at a time, the bulk verification is the best way.

Ready? Start a free trial today.